reverse tax calculator australia

Sales tax calculator GST QST 2016. Adding 10 to the price is relatively easy just multiply the amount by 11 reverse GST calculations are quite tricky.

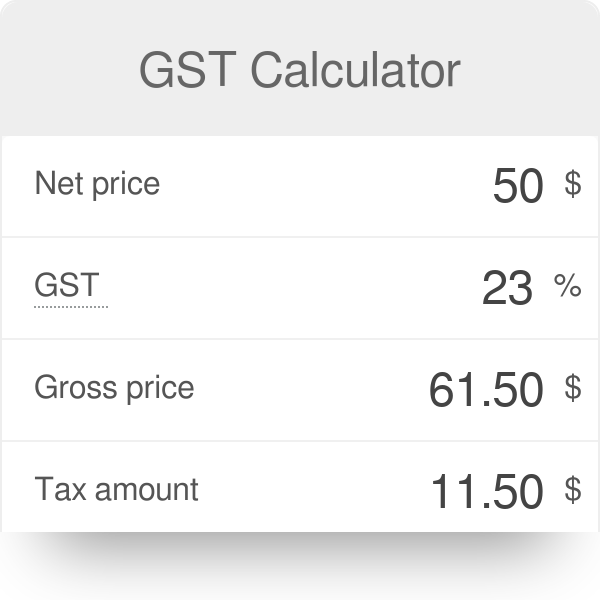

Gst Calculator How To Calculate Gst

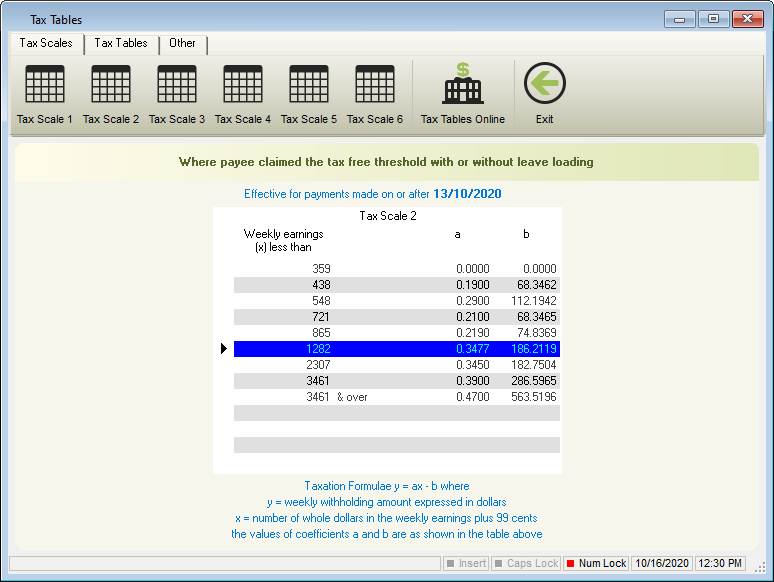

Show tax rate table.

. Amount with sales tax 1 GST and QST rate combined100 or 114975 Amount without sales tax. Amount without sales tax GST rate GST amount. If your total receipt amount was 5798 and you paid 107 percent in sales tax youd simply plug those numbers into our calculator to find out that your original price before tax was 5737.

Amount without sales tax GST rate GST amount. Just multiple your GST exclusive amount. This is the after-tax amount.

The reverse tax calculator calculate net earnings to gross earnings. Jun 17 2013 104200 AM We have just released a new calculator in the Lawyers Section - Compound. This app is especially useful to all manner of professionals who remit taxes to government agencies.

For the second option enter the Sales Tax percentage and the Gross Price of the item which is a monetary value. For the first option enter the Sales Tax percentage and the Net Price of the item which is a monetary value. It can be used for the 201314 to 202021 income years.

For the 2016-17 financial year the marginal tax rate for incomes over 180000 includes the Temporary Budget Repair Levy of 2. 17 Aug 2021 QC 16608. Calculate Australian tax figures fast.

The Reverse Tax Calculator is part of the Lawyers Section of Dolman Bateman. Sales tax calculator GST QST 2016. Tax rate for all canadian remain the same as in 2017.

Australian Goods and Services tax history. Compound Interest in 25 Seconds. Simply enter any one field press the calculate button and all the other fields will be shown.

Calculator of the GST in Australia 10 free calculator for Australians in 2022. 2020-2021 pre-budget reflects the tax rates prior to those announced in the Budget in October 2020. The GST is a broad-based tax of 10 on the supply of most goods services and anything else consumed in Australia.

Current HST GST and PST rates table of 2022. Français Home page calculator and conversion. GST in Australia was started to charge on 1st of July 2000.

You will need to input the following. On March 23 2017 the Saskatchewan PST as raised from 5 to 6. This calculator helps you to calculate the tax you owe on your taxable income.

Here is how the total is calculated before sales tax. Amount without sales tax QST rate QST amount. This link opens in a new window.

Price before Tax Total Price with Tax - Sales Tax. Here is how the total is calculated before sales tax. A pay period can be weekly fortnightly or monthly.

Sales tax amount or rate. To find out more about joining the Lawyers Section click here. Current financial year 2020 2019 2018 2017 2016 2015 2014 2013 2012 2011 2010 2009 2008 2007.

It can be used for the 201314 to 202021 income years. Enter the final price or amount. From there it is a simple subtraction problem to figure out that you paid 61 cents in sales tax.

In most cases your employer will deduct the income tax from your wages and pay it to the ATO. It is always was 10 rate thought there are attempts to increase it to 15 but it didnt happened yet. Reverse Sales Tax Calculations.

Amount without sales tax QST rate QST amount. Calculate Sales tax US. Français Home page calculator and conversion.

Sales Tax Rate Sales Tax Percent 100. The calculator takes into account Medicare Levy and the Low Income Tax Rebate but does not take into account other rebates such as the Family Tax Benefits Social Security Rebates. Reverse Sales tax calculator British-Columbia BC GSTPST 2017.

How to calculate Australian GST manually. The gross pay estimator will give you an estimate of your gross pay based on your net pay for a particular pay period. Amount without sales tax GST rate GST amount.

Formula How to calculate GST formula GST is calculated by multiplying the GST rate 10 in Australia by the total pre-tax cost. See the article. It will take between 2 and 10 minutes to use this calculator.

The only thing to remember in our Reverse Sales. Reverse Sales tax calculator British-Columbia BC GSTPST 2017. Amount without sales tax QST rate QST amount.

Enter either the sales tax amount in dollars such as 10 for 10 or the sales tax rate such as 85 for 850. As well as entrepreneurs and anyone else who may need to figure out just how. There are two options for you to input when using this online calculator.

21 Hill St Roseville NSW 2069 Australia. Amount with sales tax 1 GST and QST rate combined100 or 114975 Amount without sales tax. To calculate Australian GST at 10 rate is very easy.

Calculate Sales tax US. 52 rows This reverse sales tax calculator will calculate your pre-tax price or amount for you. This estimator will help you to work out an estimate of your gross pay and the amount withheld from payment made to.

To use the sales tax calculator follow these steps. Here is how the total is calculated before sales tax. Amount with sales tax 1 GST and QST rate combined100 or 114975 Amount without sales tax.

The cost of GST is then added to the purchase. 75 of goods x 10 GST 750 GST. Reverse Tax Calculator is a simple financial app that allows you to quickly and easily figure out just how much of that sales total was actually taxes.

Includes 2 medicare levy and low income tax offset. Show me tax rates for. Calculator of the GST in Australia 10 free calculator for Australians in 2020.

Where Sales Tax is the dollar amount of sales tax paid Sales Tax Percent is the state sales tax as a percentage and Sales Tax Rate is the state sales tax as a decimal for calculations.

5 Simple Steps For 1000 Emergency Funds Emergency Fund Reverse Mortgage Mortgage Payoff

Net To Gross Income Calculator Assured Lending

Using Your Home Equity To Purchase An Investment Property Mortgage Loans Home Equity Loan Home Loans

Free Workout Log1 Workout Log Workout Free Workouts

How To Calculate The Tax In Australia Quora

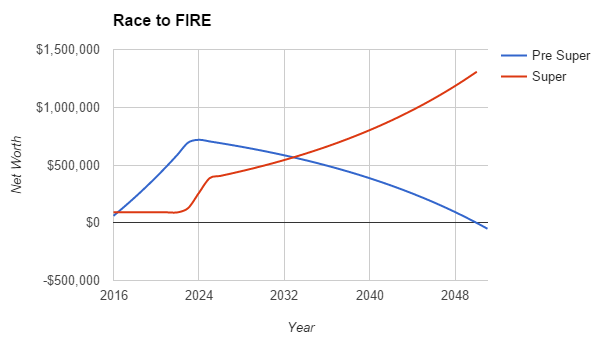

Australian Financial Independence Calculator Aussie Firebug

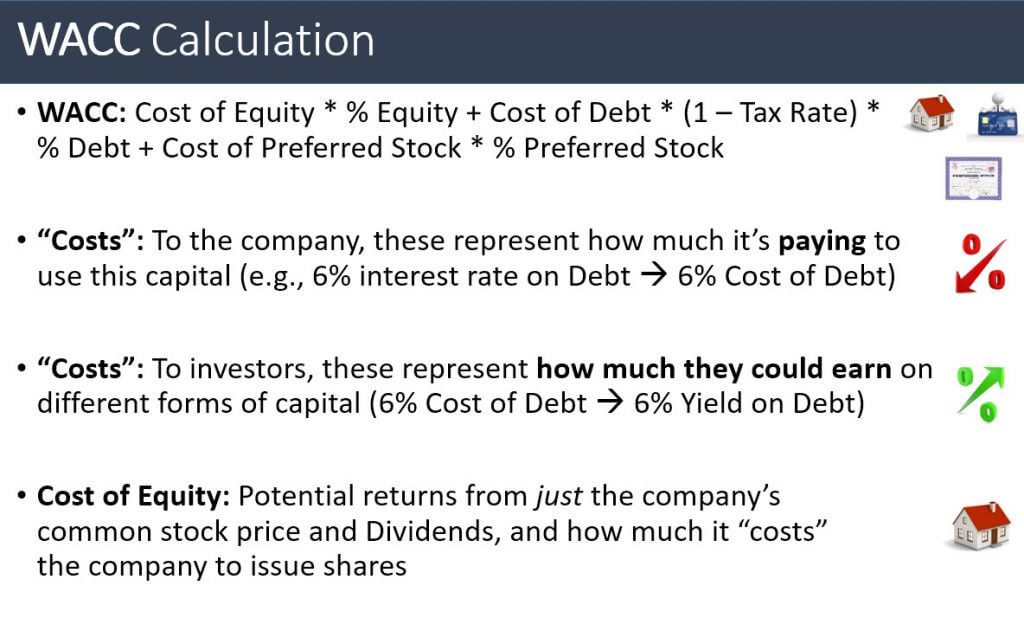

How To Calculate Discount Rate In A Dcf Analysis

Tax Rate Changes From The 2020 21 Budget Benefit Accounting

How To Make Calculating Gst Easier

How To Dodge Mortgage Insurance Fees When Applying For A Home Loan Infographic Mortgage Payment Calculator Mortgage Payment Home Mortgage

![]()

Free Income Tax Calculators Australia Ashburn Tax Accountants

How To Calculate Gst In Excel By Using Different Techniques With Easy Step By Step Tutorial Youtube

Commercial Property Lease Or Buy Analysis Calculator Investment Analysis Commercial Property Analysis

Tax Scale 2 Australian Resident Claiming The Tax Free Threshold E Payday Legacy Payroll User Guide 1

Crypto Tax In Australia The Definitive 2021 2022 Guide

![]()

Free Income Tax Calculators Australia Ashburn Tax Accountants

/dotdash_Final_Deferred_Tax_Asset_Definition_Aug_2020-01-dab264b336b94f939b132c55c018f125.jpg)

/dotdash_Final_Deferred_Tax_Asset_Definition_Aug_2020-01-dab264b336b94f939b132c55c018f125.jpg)